Investors in financial markets are faced with an abundance of potentially value-relevant information from a wide variety of different sources. In such data-rich, high-dimensional environments, techniques from the rapidly advancing field of machine learning (ML) are well-suited for solving prediction problems. Accordingly, ML methods are quickly becoming part of the toolkit in asset pricing research and quantitative investing. In this book, Stefan Nagel examines the promises and challenges of ML applications in asset pricing.

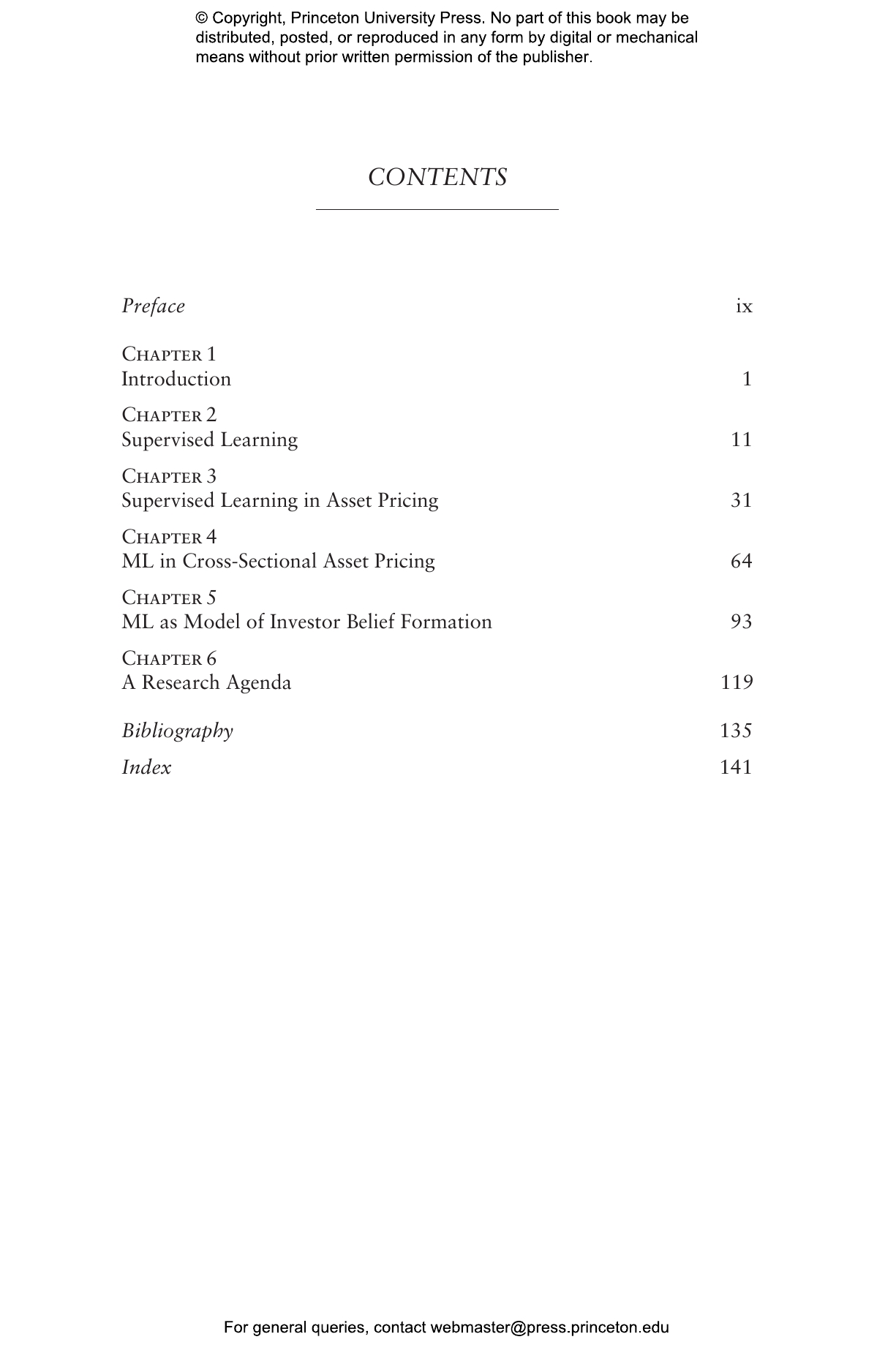

Asset pricing problems are substantially different from the settings for which ML tools were developed originally. To realize the potential of ML methods, they must be adapted for the specific conditions in asset pricing applications. Economic considerations, such as portfolio optimization, absence of near arbitrage, and investor learning can guide the selection and modification of ML tools. Beginning with a brief survey of basic supervised ML methods, Nagel then discusses the application of these techniques in empirical research in asset pricing and shows how they promise to advance the theoretical modeling of financial markets.

Machine Learning in Asset Pricing presents the exciting possibilities of using cutting-edge methods in research on financial asset valuation.

Stefan Nagel is the Fama Family Professor of Finance at the University of Chicago, Booth School of Business. He is the executive editor of the Journal of Finance, a research associate at the National Bureau of Economic Research, and a research fellow at both the Centre for Economic Policy Research in London and the CESIfo in Munich. Twitter @ProfStefanNagel

"The book shows the advances Machine Learning offers for academic research. The book certainly makes a difference in the exploding literature on Machine Learning and I highly recommend it to all academics in finance."鈥擳horsten Hens, Journal of Economics

"Asset return prediction is a complex, high-dimensional problem for which machine learning methods hold great promise. Yet that promise cannot be realized without the sophisticated economic and statistical reasoning that Stefan Nagel lays out so clearly and intuitively in this book. Machine Learning in Asset Pricing is an indispensable resource for both finance academics and quantitative investors."鈥擩ohn Y. Campbell, Harvard University

"This delightful, concise, and informative book offers timely insights into asset pricing models through a machine learning lens. It serves as a vital foundational resource for anyone interested in developing a thorough understanding of the field."鈥擩ianqing Fan, Princeton University

"Stefan Nagel gives an insightful introduction to the new and rapidly growing area of machine learning鈥揵ased asset pricing. He expertly links sophisticated methods to the theoretical finance problems for which they are suited. This book is an invaluable resource for those interested in improving the research and practice of finance using the powerful tools of machine learning."鈥擝ryan Kelly, Yale University

"Low signal-to-noise ratios and structural change pose severe challenges to successfully applying machine learning methods to forecast security prices. This gem of a book makes a strong case for exploiting prior insights from asset pricing models and portfolio analysis to guide training and regularization strategies in ways that can help improve the performance of machine learning methods in asset pricing."鈥擜llan Timmermann, University of California, San Diego