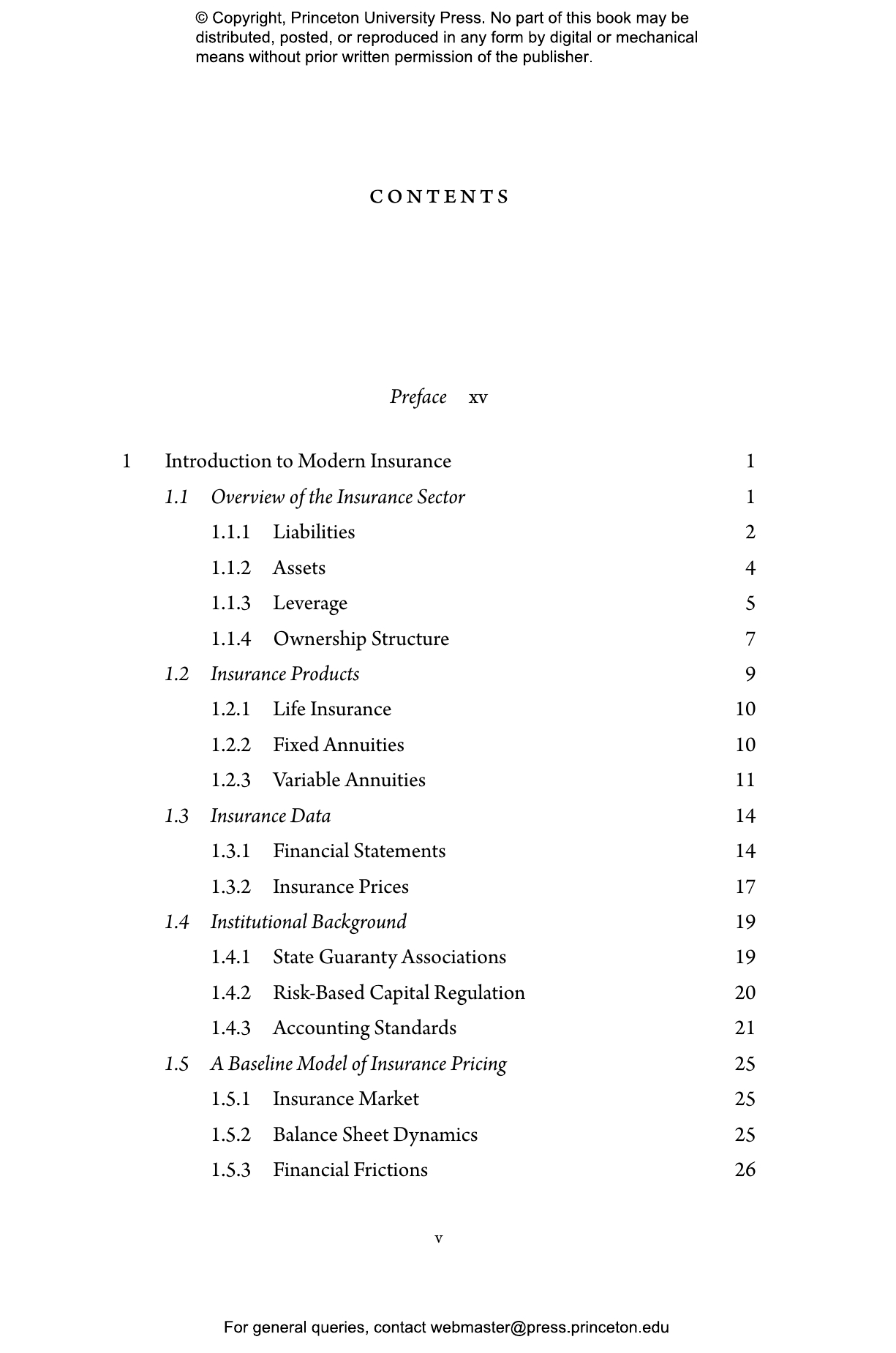

The traditional role of insurers is to insure idiosyncratic risk through products such as life annuities, life insurance, and health insurance. With the decline of private defined benefit plans and government pension plans around the world, insurers are increasingly taking on the role of insuring market risk through minimum return guarantees. Insurers also use more complex capital management tools such as derivatives, off-balance-sheet reinsurance, and securities lending. Financial Economics of Insurance provides a unified framework to study the impact of financial and regulatory frictions as well as imperfect competition on all insurer decisions. The book covers all facets of the modern insurance sector, guiding readers through its complexities with empirical facts, institutional details, and quantitative modeling.

- An up-to-date textbook for graduate students in economics, finance, and insurance

- Covers a broad range of topics, including insurance pricing, contract design, reinsurance, portfolio choice, and risk management

- Provides promising new directions for future research

- Can be taught in courses on asset pricing, corporate finance, industrial organization, and public economics

- An invaluable resource for policymakers seeking an empirical and institutional account of today’s insurance sector

Ralph S. J. Koijen is the AQR Capital Management Distinguished Service Professor of Finance at the University of Chicago Booth School of Business. Motohiro Yogo is a Professor of Economics and the Hugh Leander and Mary Trumbull Adams Professor for the Study of Investment and Financial Markets at Princeton University.

“Using the tools of financial and regulatory economics, this volume delivers a host of new and interesting insights on the insurance industry and the forces that determine the supply of insurance products. It provides a firm foundation for a rich new research program on a key component of the financial sector.”—James Poterba, professor of economics at the Massachusetts Institute of Technology and president of the National Bureau of Economic Research

“The growing heft of the nonbank financial sector has commanded attention from central banks and financial authorities around the world. This book presents a masterful study of the insurance sector as a core part of the landscape. The authors show how an understanding of the institutional details and regulatory backdrop is crucial in gauging the impact of the insurance sector on the broader financial system, and uncover a rich set of research questions along the way. This book is a must-read for serious observers of financial markets and researchers in financial economics.”—Hyun Song Shin, Bank for International Settlements

“This book presents a unique combination of facts and modeling, using a novel and unified framework. It’s full of hidden nuggets and is absolutely a must-read for any graduate student in finance or economics who wants to take a deep dive into the supply side of the ever-growing insurance business. Once you are done with the book, you’ll have multiple new leads for exciting research projects, and a coherent conceptual framework as to how to go about them.”—Liran Einav, Stanford University

“With an artful blend of empiricism and theory, Koijen and Yogo provide a definitive study of the impact of market incentives and regulation on the financial performance of the insurance industry. Graduate students and regulators, especially those interested in life insurance, will take away a deep understanding of how the pricing of insurance interacts with the risk management of insurers’ balance sheets.”—Darrell Duffie, author of Fragmenting Markets

“Anyone wanting to push the frontiers of research on insurance needs to read and study this book. Ralph Koijen and Motohiro Yogo’s pioneering research on how market frictions affect the behavior of insurance companies provides a wealth of methodologies and insights that will prove invaluable for research on this important but understudied sector of the financial system.”—David Scharfstein, Harvard Business School