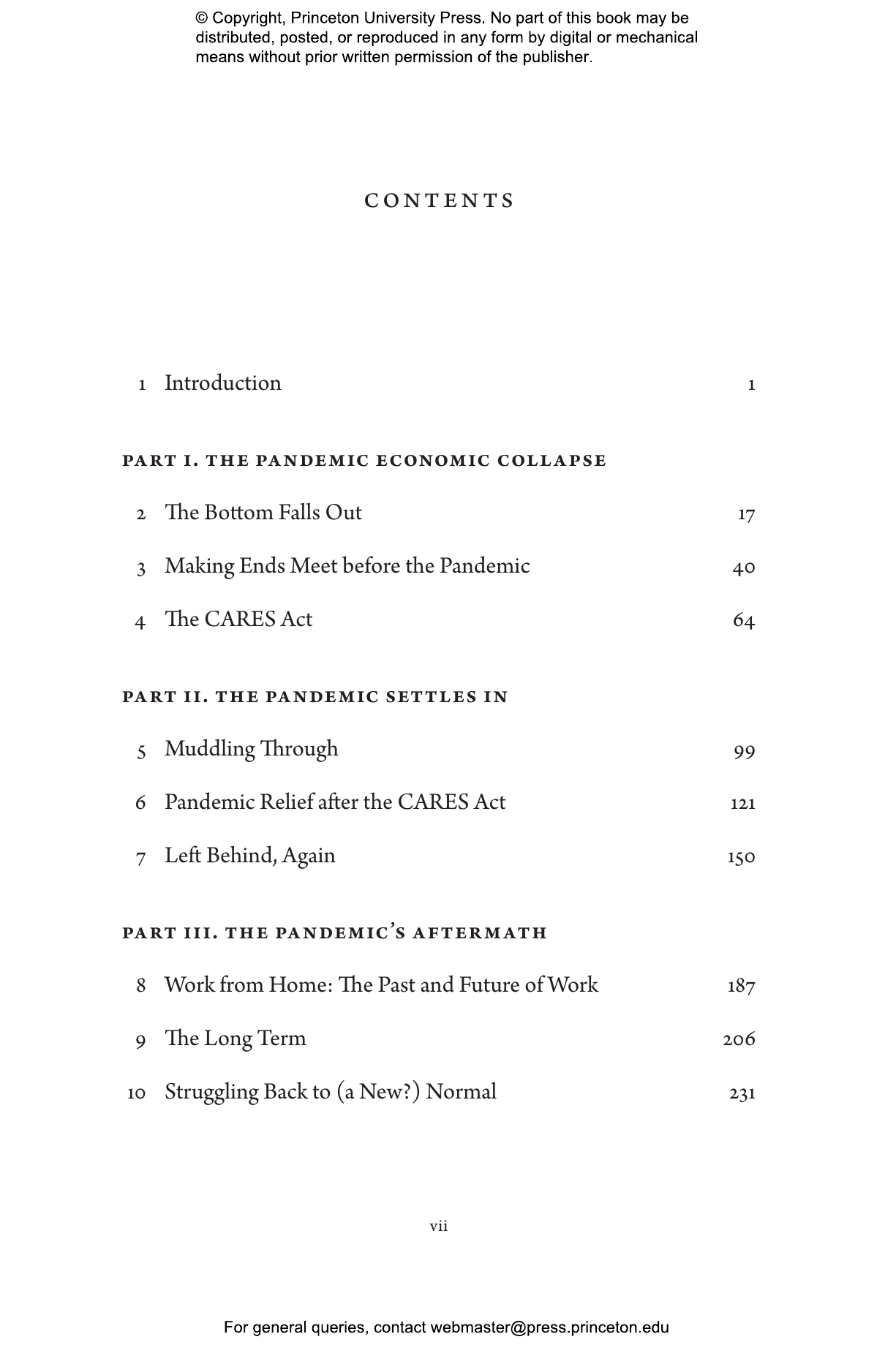

In March 2020, economic and social life across the United States came to an abrupt halt as the country tried to slow the spread of COVID-19. In the worst economic contraction since the Great Depression, twenty-two million people lost their jobs between mid-March and mid-April of 2020. And yet somehow the finances of most Americans improved during the pandemicâsavings went up, debts went down, and fewer people had trouble paying their bills. In The Pandemic Paradox, economist Scott Fulford explains this seeming contradiction, describing how the pandemic reshaped the American economy. As Americans grappled with remote work, âessentialâ work, and closed schools, three massive pandemic relief bills, starting with the CARES Act on March 27, 2020, managed to protect many of Americaâs most vulnerable.

Fulford draws from the Consumer Financial Protection Bureau’s âMaking Ends Meetâ surveysâwhich he helped designâto interweave macroeconomic trends in spending, saving, and debt with stories of individual Americansâ economic lives during the pandemic. We meet Winona, who quit her job to take care of her children; Marvin, who retired early and worried that his savings wouldnât last; Lisa, whose expenses went up after her grown kids (and their dog) moved back home; and many others. What the statistics and the stories show, Fulford argues, is that a better, fairer, more productive economy is still possible. The success of pandemic relief policy proves that Americansâ economic fragility is not an unsolvable problem. But we have to choose to solve it.

Scott Fulford is a senior economist at the Consumer Financial Protection Bureau. He has a PhD in economics from Princeton University and he taught economic and international studies at Boston College before joining the CFPB. His academic and policy research examines the economic problems individuals and households face and how they use financial products to help deal with them. He lives in Washington, DC, with his wife and two young children.

"The pandemic has wrapped up and we are getting books that are auditing our policy response. . . . Scott Fulfordâs The Pandemic Paradox . . . stuck with me. What we did to reduce poverty was really something, and itâs deeply moving to see all the good we did. Then we let it all go."âMatthew Desmond, Boston Globe

"'The Pandemic Paradox’ compellingly argues that federal largess lessened the immediate financial pain of Covid-19. Yet Mr. Fulford is unlikely to change the minds of readers who think that America overspent. If you start with some skepticism about the trillions of dollars in pandemic spending, this book will not eliminate your skepticism. But it will provide you with a thoughtful, panoramic view of the economic changes that occurred after 2020."âEdward Glaeser, Wall Street Journal

"The good news: The pandemic took less of a toll on the economy than it might have. The bad news, and thus the paradox of the title: The economic damage will last. As Fulford shows in clear and accessible prose, the world as a whole was unprepared for a devastating pandemic. . . . If youâre wondering about the dollars-and-cents effects of the virus, this book makes a lucid guide."âKirkus Reviews

"¸é±ð³¦´Ç³¾³¾±ð²Ô»å±ð»å."âChoice

âThe COVID-19 pandemic was a great disaster. But it forced us to find new ways of doing things and showed us that some things that we assumed must be true were false. One of those âtruthsâ that isnât true is that government canât help ease the financial precarity of those millions of Americans who are having difficulty making ends meet. Fulfordâs The Pandemic Paradox is a wake-up call both for those who want to help and those who say we cannot.ââAngus Deaton, winner of the Nobel Prize in Economics

âThe Pandemic Paradox makes sense of how policymakers were able to create a silver liningâimproved financial health for tens of millions of Americansâout of a massive tragedy. In the tradition of The Financial Diaries, Fulford reminds us that we have to get past standard economic analysis to truly understand the financial lives of real people, and that doing so is essential to making good policy.ââJennifer Tescher, founder and CEO of the Financial Health Network

âThe pandemic was a historically massive rupture. Yet, as Scott Fulford shows, thanks to trillions of dollars of public spending, the pandemic did not lead to a full-blown economic crisis in the United States. This surprising ânon-crisisâ is a big story. Fulford shows why and how a deep crisis was avertedâand what the governmentâs response tells us about the possibilities for public action in other circumstances. Fulford effectively tells both the big policy story and the stories of individuals adapting in the face of loss.ââJonathan J. Morduch, coauthor of The Financial Diaries